Today’s market conditions have the bears almost admitting it may be a bull run, and the investing public and institutional investors still watching.

Our Dow Projections are for the week, and for the first time, I’d like to detail to you what I believe could occur within the next 5 trading days:

The deepest bottom could be 9950. It’s unlikely.

If a true sell off occurs the next support lines run 10,090-10,117 and major support and 10,207 and 10,309. If the market continues last Friday’s retreat these are the areas the market will hesitate.

We all know that 10,550 begin a Fibonacci retracement area that runs up to resistance at 10,746. It is within this retracement area that the market has stagnated for the past several weeks.

If the market is able to actually break this resistance the bulls might run, ever so mildly.

What I do not believe is that there will be a massive correction and the Great Depression will come, as many pragmatic economists can argue.

There may well be a second stimulus, and any influx of government money worldwide; I believe would be good for the globalization that is needed for true recovery.

I sit amazed the bankers literally brought the world to the brink of financial disaster, and at all the stupidity and greed around it, but I am most amazed they will have another record year of profits by fucking the people again, and the Government still talking.

So, my projections for 2010 are easy ones, and we have to make money on holding steady in our investing, and trying for some winning options along the way.

I don’t think the market will go up much in 2010, without it coming down as much, and we’ll see a whipsaw that allows only 5 or 6% real growth.

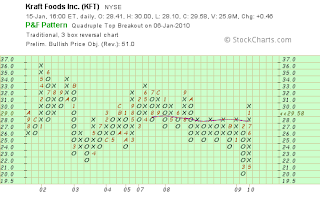

We have to spot where the volatility is, what stocks move in patterns, and we’ll begin studying together the WHY of some specific picks.

NO matter what your political stance it should be obvious that more money needs to enter the market to create jobs, even if a false illusion. Get the unemployment rate down and the market will soar.

There are no easy answers to the mess we are in. Companies are working leaner, and there is less money being spent. Hard to say, “Get us jobs” when there are just fewer jobs, and it leads to the WPA and bridge building and Roosevelt genius that built our parks and got people working. There are a lot of things that need to be done.

Most everything is obvious here, and just as obvious that nothing gets done.

Where can we make money? Ned Davis, of Ned Davis Research, says, “The crowd is finally throwing in the bearish towel and starting to believe the better economic news. However, crowd psychology often acts as a pendulum with extremes in one direction matched by extremes in the opposite direction…. I am not certain we have matched the record pessimism seen from November 2008 to March 2009. Within all this, this valuation expert remains “mostly bullish.”

We watched with surprise last week with JP Morgan Chase, which we just recently bought, came in with a strong rise in four-quarter earnings (they quadrupled), but came in light to analysts in the revenue dept.

The 38 top lenders enjoyed a record year in 2009, with revenues taking a leap forward to 449.6 billion from 306.2 billion in 2008. And all those hard working little banker employees will receive an aggregate of 145.8 billion in compensation and benefits.

Banks actually led the market, they were the “trigger” last Friday, and many astute floor traders see banking as less profitable in 2010 as the public reacts, and they actually have to try to find ways to make money other then betting and rape.

I suspect, unlike these astute floor traders, that Goldman Sachs runs the country, and that the boys at the top will still come out with incredible gains, considering all that they lost.

Let’s watch Tuesday and Wednesday especially when Citigroup, Bank of America, Morgan Stanley, and Bank of New York Mellon all report. Any risk traders that want to play the downside to the banks on earnings should play a February OTM PUT on any issue, and sell within 2 days.

Goldman Sachs and Google both report on Thursday, making this coming week one that we think will be both pivotal and livelier in volatility.