It’s important to look at the Dogs of the Dow theory as we begin this investing year.

What Does Dogs Of The Dow Mean?

An investing strategy that consists of buying the 10 DJIA stocks with the highest dividend yield at the beginning of the year. The portfolio should be adjusted at the beginning of each year to include the 10 highest yielding stocks.

The strategy was formulated in 1972 and has proven to be successful. In fact, as Dog of the Dow investors readjust their portfolios each year, it places pressure on the stocks involved.

This strategy has worked many years, but has been mediocre since 2002, and fell 38.8% in 2008, and returned only 17.8% last year, not even hitting the Dow or S &P gains of 22.68% and 26.46% annually.

Barron’s reports that each of these Dogs of the Dow looks ripe for top dividend and stock development performance in 2010.

Chevron-CVX-we own this

Pfizer-PFE

McDonalds MCD-we own this

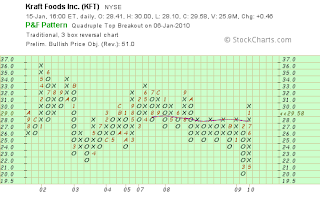

Kraft Foods KFT

ATT-T

Procter and Gamble-PG-we own Prestige Brands as an alternative to this stock

Verizon VZ

Wal-Mart-WMT-we own this

Exxon Mobil XOM- we own this

It’s interesting that Blue Chip Options owns 5 of the 10 “dogs of the Dow,” proof of our contrarian and value investing side.

Our top pick right now for a new Dogs buy is Kraft. Buffet owns 9%, so you know it’s undervalued, he’s upset about the Cadbury deal, and “something will happen.”

The chart above shows in a 3:1 ratio, quadruple top breakout, and above the moving average.

If the market falls this week Kraft KFT will be a bargain. It’s a bargain now.

Add KFT to a speculative portfolio if you are a new investor with Blue Chip Options.

If an option trader consider:

| Last [Tick] | 4.80[+] |

|---|---|

| Open | 4.50 |

| Day High | 4.80 |

| Day Low | 4.50 |

| Previous Close | 4.80 |

Closed at 4.80

This is a LEAP on KFT.

Buy at up to market, noting you will be making a second buy to this position if KFT falls to 25.00, a support line, and may hold the position hours, weeks, or months.

This could have 100% returns