Floyd at www.oexoptions.com won the 2008, 2009, and 2010 Readers Choice Advisory Service Awards from Stocks and Commodities Magazine. At www.Bluechipoptions.com we offer weekly Dow projections, daily Twitter updates, free option and stock signals, our blogs, and numerous articles on trading the market.

Saturday, November 14, 2009

Buying Paint Cheap

Here's a new stock recommendation, one that we will not be adding to our portfolio, but offering as a "roller" stock for those that want additional stocks to trade:

Sherwin Williams has taken a real hit with the slowdown in housing, but shown real resilience in bottom testing and looks ripe for upside. Most analysts see upside of 61.00 to 72.00, but risk traders may want to consider Sherwin's increasing market share, and that is value priced, spring loaded for an economic upturn. We'd set buys to take place during consolidation and we would buy it to $54.00, setting a stop loss by point and figure charging support lines of 52.00.

Friday, November 13, 2009

The USD and Carry Trades

Right now the real money has been made in investing in dying stocks (banks) and watching them skyrocket, or in investing in small cap stocks. We in the U.S. have over 75% of he world's great quality franchise stocks.

Blue Chip stock buyers, watching the large caps, should take particular interest in the laggards in the S & P 100 and S &P 500, and look at the stocks that trade at lower than market price/earnings multiples.

Real brand names that we all buy all the time are bargains: JNJ, MSFT, WMT (under $51.00), Proctor and Gamble (PG), MCD, etc.

We believe that U.S. growth will, over time, accelerate, the rise in low quality stocks will resume, and Blue Chip growth will resume, albeit at a slower pace. However, if growth disappoints we'll see a shift from the high fliers to the "sleep at night" stocks that work better with normal growth, which we anticipate in 2010.

Review our core and speculative portfolios both online, and at www.stockcharts.com where all our holdings are listed, and continue to invest a portion of your investments in the quality names; they will pay off.

__________

Of real interest, the International Monetary Fund (IMF) said Monday " traders are probably using the dollar to fund "carry trades which upward pressure to the Euro and in investing in Emerging Markets.

Economist Roubini, who forecast the financial crisis in 2006, says that investors are "unknowingly" making the "mother of carry trades"

Definition of a carry trade: http://en.wikipedia.org/wiki/Carry_(investment)

With investors able to borrow at near zero interest rates some traders are concerned that the investing idiots will continue to borrow for carry trades, with the USD suffering. In a carry trade investors borrow in countries with low interest rates to invest in higher yielding assets.

Thursday, November 12, 2009

Investing in Bloodshed

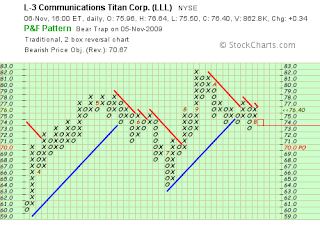

edges on the TASER, and the armed battalion gear companies, and got out.It's time to get back in. L-3 Communication Holdings (LLL) has a unique category, so even with cuts to defense that some investors are concerned about, L3 focuses on technology and asymmetrical warfare.

edges on the TASER, and the armed battalion gear companies, and got out.It's time to get back in. L-3 Communication Holdings (LLL) has a unique category, so even with cuts to defense that some investors are concerned about, L3 focuses on technology and asymmetrical warfare.In the defense sector I often review NOC, RTN, LMT, GD,and LLL. Right now LLL is selling for only 9.5 times 2010 earnings, which is a 30% discount to the sector.

Three reasons to buy:1. It's cheap2. It pays a dividend3. It's ripe for takeover

This stock could hit $100.00 next year, and we'll use a point and figure stop loss at first at 70.00, and then shift it to a 20% trailing stop loss after a few months.LLL should be bought on any market dips, as a stock in your speculative portfolio.

Monday, November 9, 2009

The GDP and False Facts

Last week the third quarter GDP showed the economy growing at a 3.5 annual pace. This broke the pace of 4 negative quarters in a row, and prompted "we are coming out of recession" talk.

The reason the GDP grew, however, should be noted that it came from GOVERNMENT intervention, not from growth in the private sector. We have to understand the facts:

1. Almost 1% of this growth came from motor vehicle production, around the cash for clunkers intervention

2. These buyers won't be there in the future, so the figure is already inaccurate.

3. Spending in research and development and product design are never figured into GDP, so if these are being cut (and they are) we are not finding new ways to produce product that we can manufacture.

So, short term we appear to have come out of the downleg, and intervention did help this. Sadly without it the bankers bets would have destroyed us all; sadder still the bankers are betting again, and no one is stopping it.

_____________

Roubini, my favorite economist, believes we are always "creating bubbles from stocks to gold to commodities". As there are few USD bulls right now it's likely as a contrarian viewer to see that the USD could stage a serious rally, and this could effectively stop the "shorting of the USD" that the bond buyers are creating. If the USD rebounds dramatically this means the world markets will be effected negatively.

_____________________

Numerically I see us topping by early January , 2010, when more of the Fibonnacci retracement (10,700 area) could hold, and the numerical significane that numbers is 0 have. As 2010 approaches I believe a combination of what we have "believe" (that it is over), what we have "created" (a false dollar), what we have "not done" (created product to sell), could catch up with us in early 2010 and force a declining optimism, and another crash, and another stimulus infusion.

Subscribe to:

Posts (Atom)