edges on the TASER, and the armed battalion gear companies, and got out.It's time to get back in. L-3 Communication Holdings (LLL) has a unique category, so even with cuts to defense that some investors are concerned about, L3 focuses on technology and asymmetrical warfare.

edges on the TASER, and the armed battalion gear companies, and got out.It's time to get back in. L-3 Communication Holdings (LLL) has a unique category, so even with cuts to defense that some investors are concerned about, L3 focuses on technology and asymmetrical warfare.In the defense sector I often review NOC, RTN, LMT, GD,and LLL. Right now LLL is selling for only 9.5 times 2010 earnings, which is a 30% discount to the sector.

Three reasons to buy:1. It's cheap2. It pays a dividend3. It's ripe for takeover

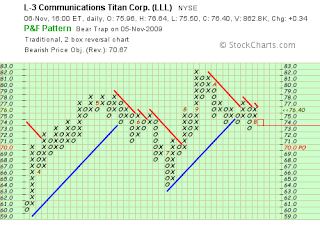

This stock could hit $100.00 next year, and we'll use a point and figure stop loss at first at 70.00, and then shift it to a 20% trailing stop loss after a few months.LLL should be bought on any market dips, as a stock in your speculative portfolio.