We invest 5 to 15% of our total portfolio in Gold and Silver, at all times. During the crash we were at 15%,and we are currently at 5 to 7%.

The remainder of our "cash" real $ portfolio (whatever your allocation is, mine being 50%) is always invested in a "laddering" of various treasury bills/bonds. "Laddering" means we dollar cost average,

buying at all times, and buying a variety of issues.

We currently own in our Real Money Portfolio:

TLT-Long term treasuries

TIPS-U.S. Treasury Inflation Bonds

GLD, SLV, SSRI-All are Gold or Silver ETF's

CEF-Canadian Exchange Fund-a cheaper way to own actual gold and silver bullion, unlike the ETF's above

EFR-Eaton Vance Senior Floating Rate Fund (this is a good alternative to TIPS)

ZTR-Zweig Total Return Fund: this is actually held in our CORE portfolios, this bond/treasury fund currently yields over 10%

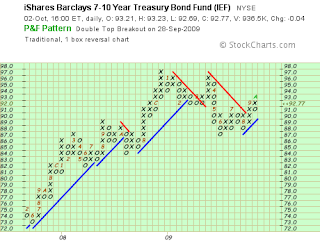

"Laddering" means holding various incremental price points, buy ins, on Treasuries, and shifting positions. For example, I am going to recommend selling TLT and shifting assets to IEF, Barclays' 7 to 10 Year Bond fund, or at least shifting a portion of cash assets. I think shorter term IEF will outperform TLT for this period.

Buy: IEF Barclays' 7 to 10 year Treasury Bond ETF at market this week, and continue to buy on any market IEF dips.